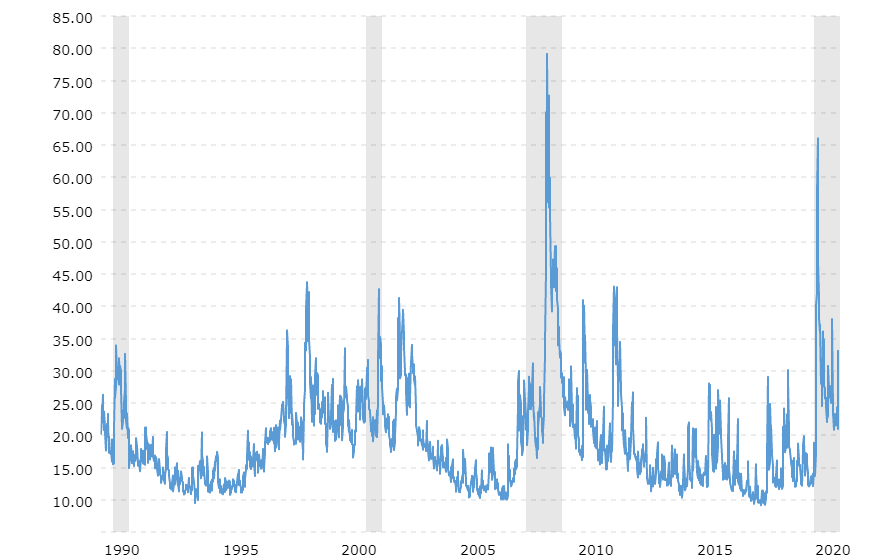

It was surmised by some that the end of the Trump Administration would mean a return to a more placid trading environment, but it has not worked out that way so far. Instead, volatility has remained high. The VIX Index, also called the “Fear Index” and which measures market volatility, has remained over 20 since last March, which Covid started, despite the election of the Biden administration, and is currently at about 21. It appears there are forces that are causing the higher volatility other than our former President.

New World

One explanation for the heightened level of the VIX and volatility is that we are in an economic situation that we haven’t seen before and therefore it is inherently volatile. We have large sections of the workforce still shut down and working from home or otherwise remotely. Only a relatively small percentage of office workers are back in their cubicles – perhaps only 20% or less. New York City has just allowed restaurants to open for indoor dining at only 25% capacity, and the long shutdown until now has caused a slew of restaurants to go out of business. A significant number of schools remain closed for in-person learning and/or are on reduced schedules. In short, we have never done this before, at least during our lifetimes, and so we really don’t know how this will all fall out. All of this uncertainty in our economy is reflected in an elevated level of volatility in our stock market. Therefore, as long as our economy as a whole remains affected by Covid and the economic restrictions therein designed to address the spread of the pandemic, you can also expect that volatility will remain high and the VIX Index will remain elevated.

Government Actions

Another explanation for the high VIX is government action, specifically the expansion of the Federal Reserve’s Balance Sheet by over $3 Trillion since the start of the pandemic and the reduction of interest rates to near 0% and longer-term rates following suit. All of that is additional money pumped into the economy hopefully to keep it afloat. Because interest rates are so low, all of that money has been invested by managers seeking higher returns, and that means more money into the stock market.

Market Concentration

Problem is, with so much of the economy diminished and corporate earnings therefrom also diminished, a lot of that money is being invested into companies who aren’t as effected by the shutdown and/or whose business models perhaps thrive during the shutdown. This means we have seen even more of a concentration in the “stay at home” stocks, especially those in the tech sector. The mega-market caps such as Facebook, Apple, Amazon, Netflix, Google/Alphabet, and Microsoft have especially benefitted. Currently, the top 10 stocks in the S&P 500 Index account for 28% of the capitalization of the entire index. This is a scary level of concentration in just a few stocks. A slip-up by any one of these companies could send the entire stock market for a tumble. Add to the mixture the ascension of Tesla now as the 5th largest market cap company in the US. Do you think Elon Musk, the head of Tesla and also the head of SpaceX, Solar City, and other ventures, is a relatively stable personality? Me neither. Once again, until “normalcy” returns in our economy, meaning likely that we reach worldwide herd immunity and/or 70% or more of the population is vaccinated from Covid, and therefore companies return to operations somewhat such as they were a little over a year ago, volatility will remain high. Also, think about what might happen between now and then. For instance, now that Amazon has captured a higher percentage of the retail sales market, will shoppers stay with Amazon once the traditional retailers open up more, and if they do will Amazon’s earnings take a hit? Will Netflix suffer if and when people return to the movie theaters? Returning to “normalcy” could mean a bloodbath for the “stay at home” stocks that have benefited from the economic shutdown.

IMO

Investors are buying stocks and sending stock index prices to record highs, but they don’t seem sanguine about it as reflected by the high level of the VIX index. Look for volatility and the VIX Index to remain high until our economy does return to some level of normalcy, new or otherwise.