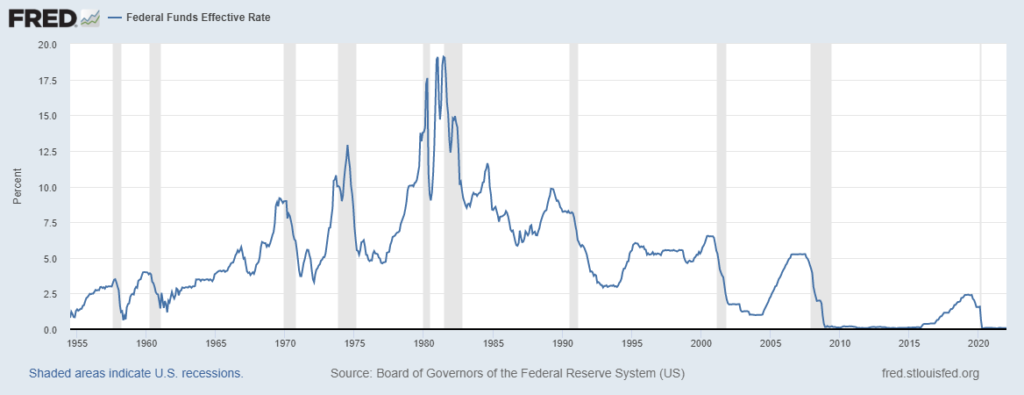

If you ever wanted to know how the treasury yield curve could become inverted, you have a textbook case of this phenomenon right now. The Federal Reserve has raised rates by 25 basis points and they have said they will continue to raise rates for the remainder of this year and probably part of next year. The debate is whether to raise rates (meaning only the short-term Fed Funds Rate) by another 25 basis points or by a more aggressive 50 basis points at the next meeting in May and the next meeting after that. The Fed anticipates that the Fed Funds Rate will be up by 2% when all is done. We’ll see about that.

US Treasury Yields:

| Date | 1 Mo | 2 Mo | 3 Mo | 6 Mo | 1 Yr | 2 Yr | 3 Yr | 5 Yr | 7 Yr | 10 Yr | 20 Yr | 30 Yr |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 04/01/2022 | 0.15 | 0.37 | 0.53 | 1.09 | 1.72 | 2.44 | 2.58 | 2.56 | 2.50 | 2.38 | 2.60 | 2.44 |

| 04/04/2022 | 0.18 | 0.42 | 0.66 | 1.14 | 1.72 | 2.43 | 2.61 | 2.56 | 2.52 | 2.42 | 2.64 | 2.48 |

Inversion

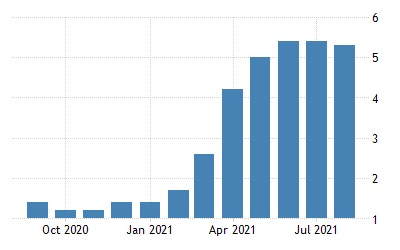

Inversion occurs because investors in longer-term Treasury securities (especially the 10 Year Note) don’t follow in lockstep with what the Fed is doing. That is exactly what is happening now. I believe there has been a long-term bull market (perhaps even a bubble) specifically in the 10 Year Note for several quarters, especially since the beginning of Covid. That bull market continues now. Whether it is international buyers of the 10 Year or mortgage lenders looking to sort-of match durations or any number of other reasons, the yield on the 10 Year has been bought down to artificially low rates. As of yesterday (April 4), the yield on the 10 Year was 2.42% and the yield on the 2 Year was 2.43%, which is a miniscule 1 basis point inversion. Hey, they say a win is a win, and so an inversion is an inversion, at least for the sake of argument with this blog post. Further evidence that the 10 Year specifically in a bubble can be found in the above-linked chart: Yields on the 3, 5, 7, and 20 Year Treasuries all exceed the yield on the 10 Year. Yet another caveat that some of the Fed governors are pointing to is also evinced on the same chart: Though the 10 Year minus 2 Year yields may be (slightly) inverted, the 10 Year minus the 3 Month yield (0.66%) is not close to being inverted; some Fed governors comfort themselves with that data.

Fault

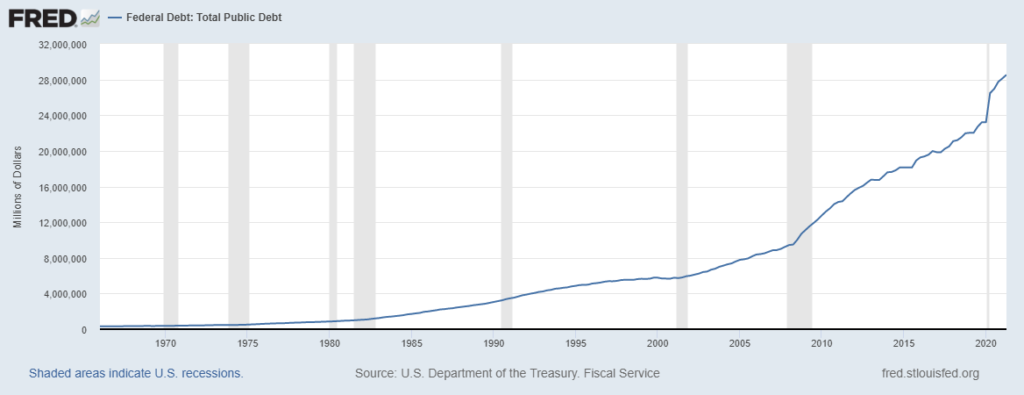

So is it the Federal Reserve’s fault that the Yield Curve has inverted? No, it is not, because the Fed is raising rates for a reason, and that reason is Inflation. The Fed’s primary method of fighting inflation is by raising short-term interest rates. Higher rates temper lending, which tempers economic activity, which tempers price increases, or so the theory goes. It’s course correcting a supertanker, but it’s important information for investors because investors are forward-looking and any data or evidence of what the future may bring will cause investors to make adjustments. With current annualized inflation at 7.9% and with supply chain problems such as the Ukraine situation and a Covid rebound in China, inflation could remain higher than anticipated for longer than anticipated. The Fed is right to take action to address inflation and they are likely several quarters behind the 8 ball and need to catch up. Covid and the fiscal, monetary, and political reactions to it have caused this inflation; the inflation boulder is rolling down the hill quickly.

Why Is It Important?

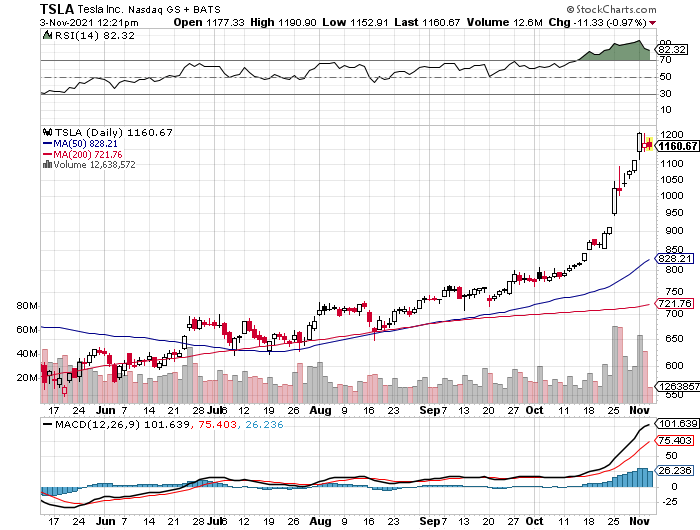

An inversion of the yield curve is important because, when it has happened in the past, it has presaged an economic recession, which means a decrease in GDP from one period to the next. Negative economic growth. Bad news for companies and employees. The previous time the yield curve inverted was in 2019, when it was thought that the economic growth that commenced as the 2008 Financial Crisis worked itself out was then on its last legs. That inversion did not predict that Covid would hit, but it was Covid that was the straw to the camel. Similarly, the yield curve inverted prior to 2008, whereafter another exogenous event (the Financial Crisis) proved to be the final straw. My point is that the previous two inversion events proved to be prophetic only in the rear view mirror and because of exogenous events. That is perhaps why investors this time are skeptical that this inversion will presage another recession and thus are continuing to like 10 Year Treasuries and are continuing to purchase stocks.

IMO

I believe higher inflation is here to stay because the just-in-time supply chain remains in a shambles, because commodities remain scarcer than they need to be, and because Russia will remain a non-player in international trade for the foreseeable future. Also, in the US, aging demographics are contributing to the “Great Resignation” and a labor shortage that is and will continue to drive wages upward. If the Fed continues to follow the Volker playbook and continues to raise rates to combat inflation, there is a good chance that a recession will result. When and how deep are the unknowns. It’s probably best to adjust your portfolios to be on the safer side, meaning hard-asset-backed stocks (oil, real estate, commodity-based companies). As to bonds, look to short-duration bond funds – more on that later.