Earlier this week, it was reported that the Consumer Price Index (CPI) had increased by 6.2% from last October to this. It was the highest reported year to year inflation rate in 31 years. Is this bad news or good news? It depends on who or what you are. If you are a consumer, a worker trying to make ends meet for your family, it is certainly bad news. The essentials of life – food, shelter, clothing, gasoline – are that much more expensive. If you are that same consumer but you own your home, then the news is mixed; you struggle on a weekly or monthly basis but your home and thus your net worth are probably higher. However, if you are the Federal Reserve Bank, the news of higher inflation is good. Why is that? Read on.

The Fed Wants Higher Inflation

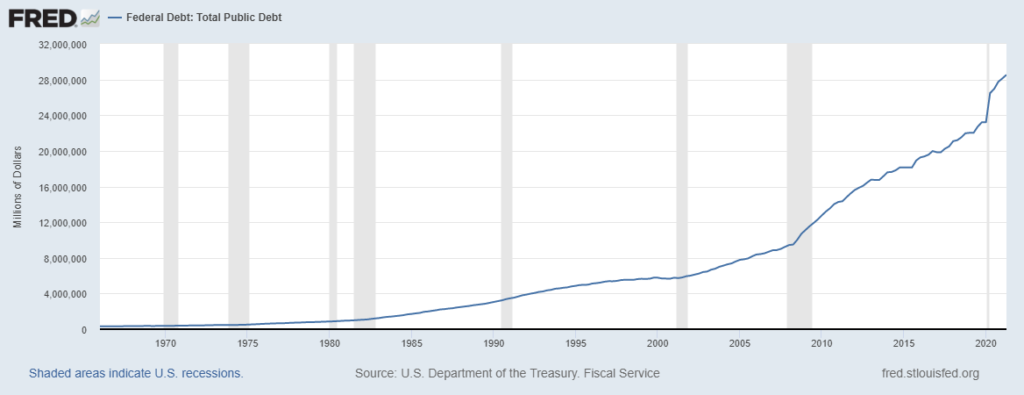

Higher inflation helps the Fed deal with its biggest long-term problem, which is the Federal deficit that has been made much larger by increased expenditures related to keeping the economy afloat during the Covid crisis. The current federal debt is just under $29 Trillion, which is about 125% of our nation’s GDP. Prior to the onset of Covid, federal debt was about $23 Trillion, meaning the US has added about $6 Trillion of debt in the last 18 months. With the US Congress contemplating $Trillions more of spending, there is no end in sight. The Fed sees the sheer amount of debt as the greatest potential problem it faces. How should the Fed address this mountain of debt? I see two levers it can use:

- Keep Interest Rates Low: The notional amount of the debt is one thing, but the amount the US Government needs to pay to service the debt (i.e., pay the interest on the debt) is another. In order to keep debt service under control, the Fed should try to keep interest rates as low as it can for as long as it can. During a recovering economy, such as that we are in currently, the trick is to keep rates low but not so low that it sparks much higher inflation. The Fed believes currently that an increase in real wages is the key: as long as real wages remain low, then inflation will remain under control, and therefore interest rates can remain on the low side. Time will tell if this theory will prove correct. But, even if inflation does increase, it’s not all bad for the Fed, because…

- Higher Inflation Devalues Debt: During inflation, the value of assets increase, but the value of debt does not, meaning that the relative value of debt goes down in relation to the value of assets. In addition, if inflation causes federal tax revenue to increase because of higher wages and higher current income and capital gains tax revenue due to the increase in the value of stocks, that means there is more federal revenue to service the increased debt, meaning that the federal deficit doesn’t look so bad in percentage terms. In effect, the Fed is trying to spur the economy to grow its way out of its high level of debt. It is a reasonable approach by the Fed, so despite the lip service it pays to its mandate of keeping inflation under control, I believe the Fed is happily pursuing higher inflation because it views the mountain of national debt as a greater issue.

Who Wins, and Who Loses?

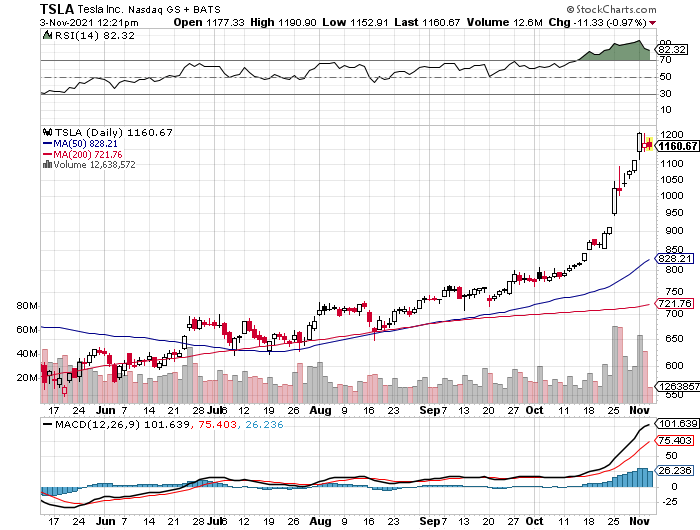

People who own assets will benefit from higher inflation. Owners of stocks, including owners of 401k and IRA accounts, and managers of pension funds, as well as owners of homes and certain other types of real estate, will benefit from higher inflation. These assets will rise in value during inflation. Are you a Crypto player? Bitcoin has had a strong run this year, corresponding with the 6.2% inflation number. Same with gold.

On the other hand, if you don’t own assets, you will lose out. If you rent an apartment, expect your rent to increase, which could put you in a bind if you are also trying to feed yourself and pay for gasoline to get to work. Inflation makes the gulf between the haves and the have-nots much worse. If you thought economic inequality was bad before Covid, wait until you see what the statistics look like in a year. If there was civic unrest then, be prepared for more unrest in the future.

IMO

Don’t pay as much attention to what the Fed says. Instead, pay attention to what they do. They are keeping short term rates low and are continuing to make open market purchases of bonds (perhaps at a tapering level) so that the yield curve and debt service coverage remain manageable. At the same time they are allowing inflation to run above their 2% target, saying 1) it is transitory; 2) the higher current rate is just making up for years of inflation below 2%; and 3) the unemployment rate remains higher than before Covid and real wages aren’t high enough yet to spark long term inflation. Inflation helps their cause, and low rates help them get there. All of that tells me that you should be long and continue to own appreciating assets such as stocks and stock indexes.