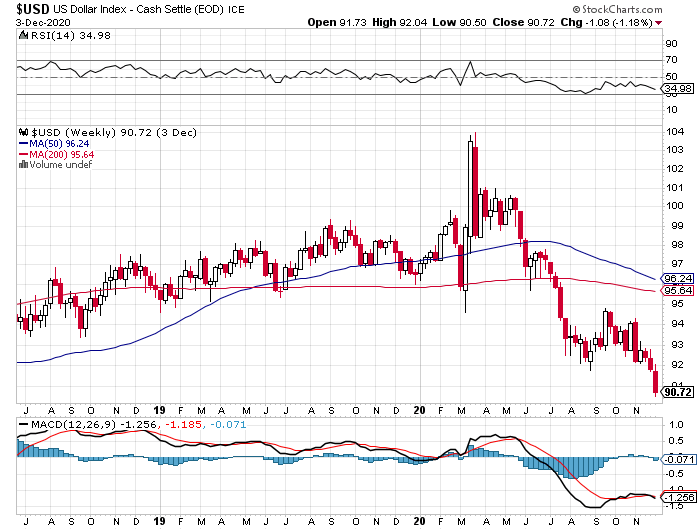

Since May 2020, the US Dollar, as measured by the Dollar Index futures contract, is down about 10%, while the price of oil (West Texas Intermediate Crude) is up about 43%, gold is up about 5%, the S&P 500 is up about 34%, and Bitcoin has about doubled. The housing market has remained strong as well. Has it been a coincidence that the dollar has declined while all of these other asset classes have grown stronger? No it is not a coincidence. In fact, part of the reason why many asset classes have grown is because the dollar has declined.

What Happens When the Dollar Declines

When the US Dollar declines, it costs less for foreigners or foreign countries to purchase US goods and US assets. What appears to have happened is that foreign institutional investors have bought heavily in the US stock market over the past 6 month, enticed by the performance of US large cap stocks in particular. Aiding in this trend has been low US and worldwide interest rates and the US Fed’s open admission that rates should remain low for the next several quarters. That means that these foreign institutional investors who once may have allocated a higher percentage of their portfolios to US bonds are now allocating more to US stocks in search of higher returns. That means more demand for stocks, and when demand increases with supply remaining the same, the price will go up. All this is not to take away domestic investors and their own engine behind the increase in US asset prices, but that in combination with these changes in the behavior and actions of foreign investors as a result of the decline in the US dollar’s value have combined to fuel the rally we have seen in these non-bond asset classes.

Why the Dollar is Declining

The Dollar Index measures the dollar against a basked of international currencies. These are mostly the other major currencies around the world, such as the Euro, Yen, Pound, and other majors. As such, it is a relative valuation and not pegged to any specific other asset such as gold. Low interest rates in the US have played a part in the dollar’s decline, as has the US’s continued issues with the pandemic. According to this recent Wall Street Journal article, the dollar has declined in the past month or so because it is perceived that international economies, which have been even harder hit by the pandemic than has the US economy, will recover at a steeper pace with the imminent Covid vaccines than will the US economy. This is not to say the US recovery will be weak, rather that the recovery in international markets will be at a steeper percentage than the US recovery. My point is that the dollar’s value is relative and not absolute, so we should not be concerned that the dollar’s recent decline is indicative of a pending implosion in the US economy.

IMO

The title of the WSJ article that I referenced in the previous paragraph is “The Dollar Is Weak. Investors Bet It Will Slide Even More.” When I read a headline like that, my intuition is that the opposite will happen. If you are thinking that the dollar’s decline is the “all clear” signal you have been waiting for and that you should jump on the stock market bandwagon, my advice is, “not so fast.” Often when a strong consensus in the stock market establishes itself, the situation changes and the trend either ebbs or reverses. Personally, I am long in the stock market but not just because I expect the dollar to continue to weaken. Instead, I believe US corporate earnings will continue to improve in no small part because interest rates remain low together with the upcoming vaccine. It will be a bumpy ride but if you remain long for the long ride you likely will be rewarded.