“Uncertainty” is now a catch-all reason for why we have sell-offs in the stock market. “Uncertainty regarding a new trade deal with China”, and “Uncertainty regarding the direction the Federal Reserve will take” are two of the more prominent excuses for bad days in the market.

Millennials

Having been around for many cycles, and being the parent of Millennial children myself, I don’t think it used to be this way. Particularly since the Fed’s actions coming out of the Financial Crisis of 2007-2009, I believe investors, and especially the Millennials who cut their teeth during those years, became used to and overly reliant on the Fed broadcasting its moves before they happen. Then, any change to the Fed’s stated plan of action is met with selling due to “uncertainty”. Earlier this year, the Fed got pummeled in the financial media for stating they would be more “data dependent” for future rate hikes rather than clearly stating they would raise x-amount of times over the next year.

China and Trade

Likewise with China. We have gotten used to inexpensive Chinese and other foreign goods coming into our market, so much so that it became a basic foundation for our US economy. Now we have a President who thinks we are overall not getting the better of that relationship. This has caused caterwauls of uncertainty. I am not condoning tariffs, but I am suggesting that the caterwauls have been overdone.

Apple

Another instance of overreaction to uncertainty is when Apple announced it would no longer provide unit sales for the iPhone (and its other products) in an effort to get analysts and investors to look at revenue rather than unit sales. AAPL lost almost 10% of its market cap in the few days after this announcement on November 1, 2018, and, after recovering a bit, proceeded to lose about 38% of its market cap peak-to-trough through the end of 2018. AAPL has recovered about 21% since then, but I see the 2018 drawdown as a huge overreaction to not knowing how many iPhones they were selling. Analysts and investors had become conditioned and had gotten used to knowing unit sales with certitude, and taking that certitude away from them made them mad.

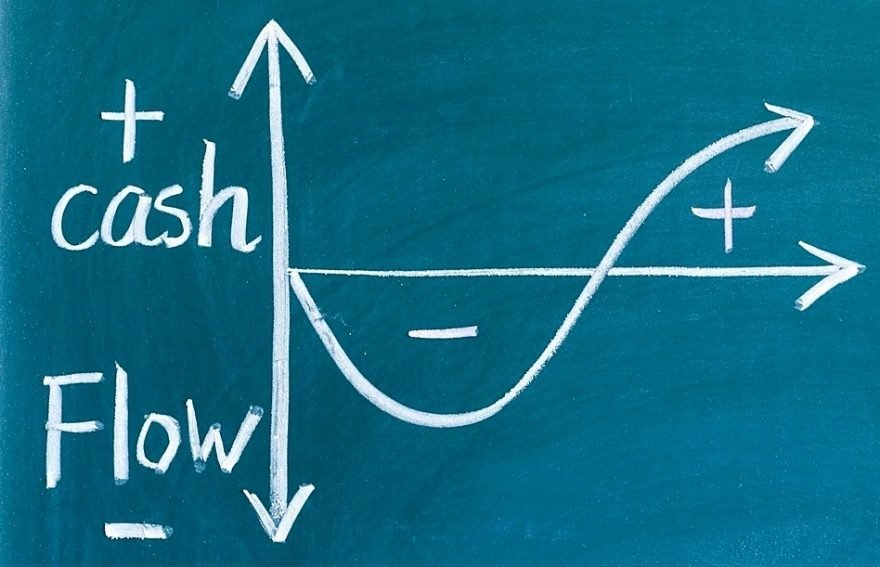

You Can Profit

You can profit if you are willing to live with what others consider to be added uncertainty. For instance, are you ok with Apple publishing revenue numbers but not unit sales? Others are not ok, but if you are, and you still believe in AAPL’s future earnings, then you may have a leg up and you might have a good buying opportunity. Are you ok with the Fed not telling you exactly how many interest rate increases they plan to do during 2019? Others are not ok with that because it is a change from the way the Fed has been doing business for the last 10 years. However, if you are ok with a more “data dependent” and flexible Fed approach, then you can profit by keeping a cooler head about you. Data fluctuates. Don’t you think it is wiser to keep data fluctuations in mind before making decisions that affect the nation’s economy? I do. Do you really believe, when all is said and done, that there will be a drastic change in the number of goods the US will import from China and other low-cost producers? Possibly, I believe, but not sufficient to have caused all of the drama that has fallen out over the day-to-day reporting of Trade Negotiations with China.

IMO

This is a variation on the Warren Buffet riff – “Be greedy when others are fearful.” I am not saying you should be greedy. I am saying that what actually happens after the reported “uncertainty” ends up being not really that bad. If you can live with a few downs to go along with the many ups, then you will probably make out ok in the long run.