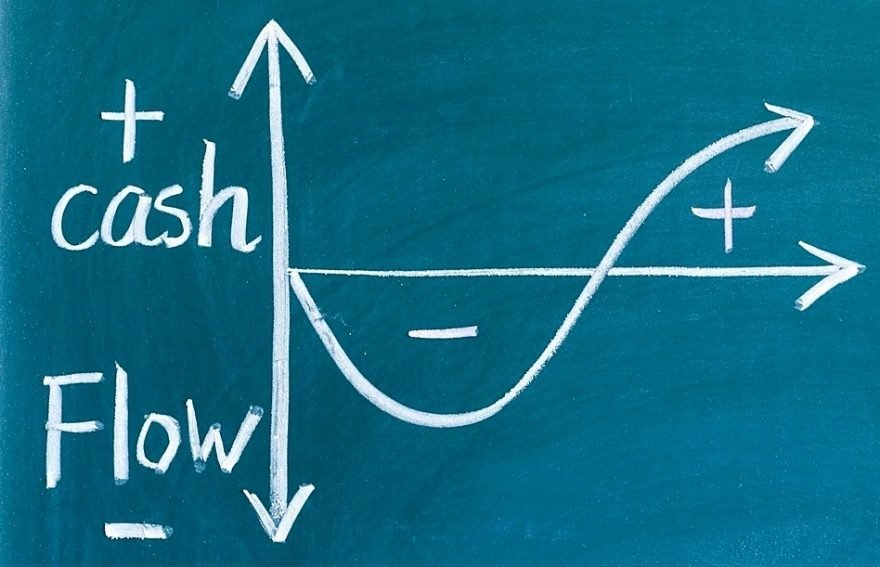

A good way for you to look at companies is to determine whether their cash flow generation is positive or negative. A company that generates positive cash flow is one that is probably self-funding, meaning that it does not need outside investment to continue to operate. It can stand on its own, thank you very much. Typically a company that generates positive cash flow is one that is well-established and that has a product or line of products that it sells that generates the cash that the company reinvests back into business operations. Kind of like a perpetual motion machine. Maybe these cash flow-positive companies have so much free cash flow from operations that they also pay dividends to their shareholders, which is an added bonus.

On the other hand, a company that has negative cash flow is one that needs additional outside cash infusions in order to continue to operate. These are usually young companies that have products that are in the research and development stages that have yet to be approved by the appropriate authorities (but which show high promise), or companies in the early stages of product sales that need to grow into their overhead. Think about a new pharmaceutical or medical device company with a great new innovation that needs money to get the innovation approved and/or brought to market.

Warren Buffet

Given my description of these two types of companies, why would you invest in a company that continually needs additional capital in order to survive? Shouldn’t you just invest in companies that throw off excess cash flow? The Oracle of Omaha, Warren Buffet, would agree with you. Excess cash flow is an important part of his “margin of safety” and is also perhaps the main objective of his investments, which is to capture excess cash

Potential

A cash-flow-positive company is great, but newer companies that are in the earlier stages offer potentially much greater returns. It used to be that companies didn’t IPO until they were cash-flow-positive, but that changed with the initial Dot Com boom 20-25 years ago (!!?? can it be that many years ago?) Although the trend has eased in the last 5 years, companies are IPO’ing earlier and earlier in their life cycles, as their managers see the public markets as the best way to mainline the blood that they need, namely, more and more cash. With more potential comes more risk, however, so you really need to be careful when you invest in companies that are cash-flow-negative. Either

IMO

My main point with this blog post is to encourage you to analyze companies in an effort to answer the question of whether the company is cash-flow-positive or cash-flow-negative. This high-level determination will give you further insight as to how the company operates its business and what you might expect in the future if you decide to buy stock in that company. In my next post, I will draw on this positive vs. negative cash flow concept to show you how you can diversify your portfolio in ways that are different than you might currently think about diversity.