Security is a major issue. Now that most of our bank and brokerage accounts are online and have online portals, it is more important than ever now to ensure that your accounts are secure and that nobody can hack in and steal your identity, or, worse yet, steal your money.

Two Factor Authentication

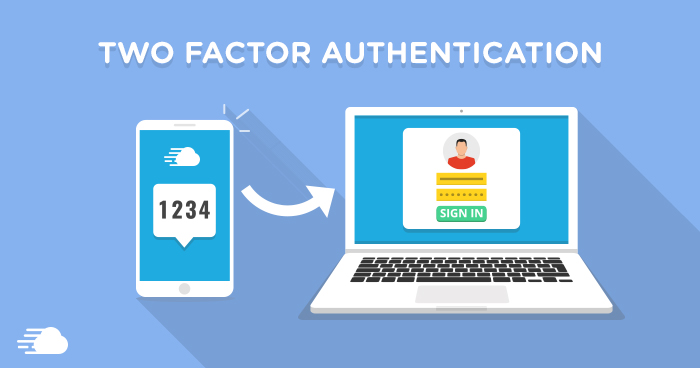

One method that is increasingly popular because it is effective is Two Factor Authentication. Maybe you already have it for your accounts, and if you don’t already, you should. What is it? With Two Factor Authentication, you have your traditional user ID and Password when you log into your account on a financial website. Then, after you have input your ID and Password, the site will ask you for further information. In the case of one of my accounts, it asks for information from a Key Card, which is a credit card-sized card with numbers and letters. This particular site will give me two numbers, and I must provide the characters that correspond to those two numbers in order to log into my account. This makes it much more difficult, if not impossible, for a bad guy to hack into my account.

Face ID

Now that more cell phones have the face id feature, this makes it much more convenient to implement Two Factor Authentication. Once you input your ID and Password, instead of asking for information from a Key Card that the bank has given you, the website will ask you to log into your cell phone. This means you have to have your cell phone with you when you log in on your computer, but that is probably not a stretch for most people. If you are using the app portal on your cell phone, all the

IMO

Though not yet mandatory, most banks and brokerages are moving toward the Two Factor Authentication model because it is that much more secure. If you are logging in to any site that doesn’t have to do with your money, such as social media sites, then you can decide if Two Factor Authentication is worth the hassle. However, when it comes to any site that links to any of your money, including your credit card accounts, then I highly recommend that you protect yourself and upgrade your security so that you have Two Factor Authentication. Once you get used to using it, it is really not any hassle to use it. Don’t continue to put yourself and your money at risk – sign up for Two Factor Authentication for your bank, credit card, and brokerage accounts today!